Transform Compliance with

Taxable employee benefits (TEB) are an essential review point for your business, but they’re difficult to track and limited in transparency. Also known as Benefits in Kind (BIK) or Fringe Benefits, organizations need sophisticated and intelligent tools designed to help you to stay ahead of constantly changing regulations, and smart solutions that keep your business compliant, ensure you meet regulatory frameworks and streamline your processes.

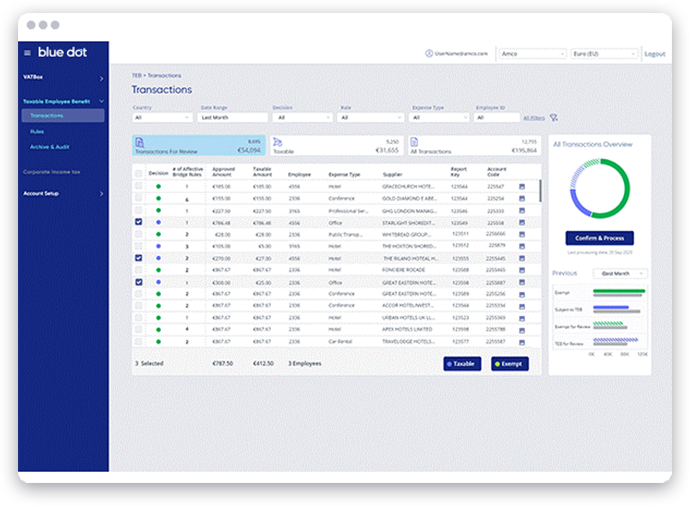

The Blue dot TEB platform is a compliant, smart and fully customisable solution that removes the risk and adds peace of mind.

Blue dot TEB – AI-powered insight

- Reduce exposure, save resources, gain complete visibility.

- Full integration with SAP Concur and other leading systems.

- Technology-powered with machine learning and artificial intelligence for deep analysis.

- Simple and intuitive.

- Comprehensive taxable employee benefits auditing across multiple countries.

Blue dot: Smart solutions for employee-driven spend

The Blue dot TEB platform digitises complex processes, saving you time and money. Designed as an enterprise-to-enterprise solution, it easily handles the complexities of employee-reported expenses subject to TEB and provides you with streamlined functionality and ongoing innovation and development.

We consistently add sophisticated extractors that are capable of undertaking advanced analytics of your data so you are assured that the information falls under the TEB remit. Every innovation aligned with your business needs and requirements.

Experience best in class TEB performance

Take advantage of our 30-day free trial* and experience:

- Enhanced and up-to-date taxation rules per supported country.

- Advanced and innovative capabilities.

- Best practice and automatic rule changes.

- Customised taxation rules to fit your needs.

- Full control over automation and transaction review.

- Platform performance optimised for your business.

* Terms and conditions