Blue dot’s platform automatically processes travel and expense data, accounts payable transactions, invoice and receipt images to maximize the recovery of VAT, GST and Consumption Tax, and automates compliance for fringe benefits, and travel policy — across countries and systems.

Blue dot’s Solutions:

VATBOX

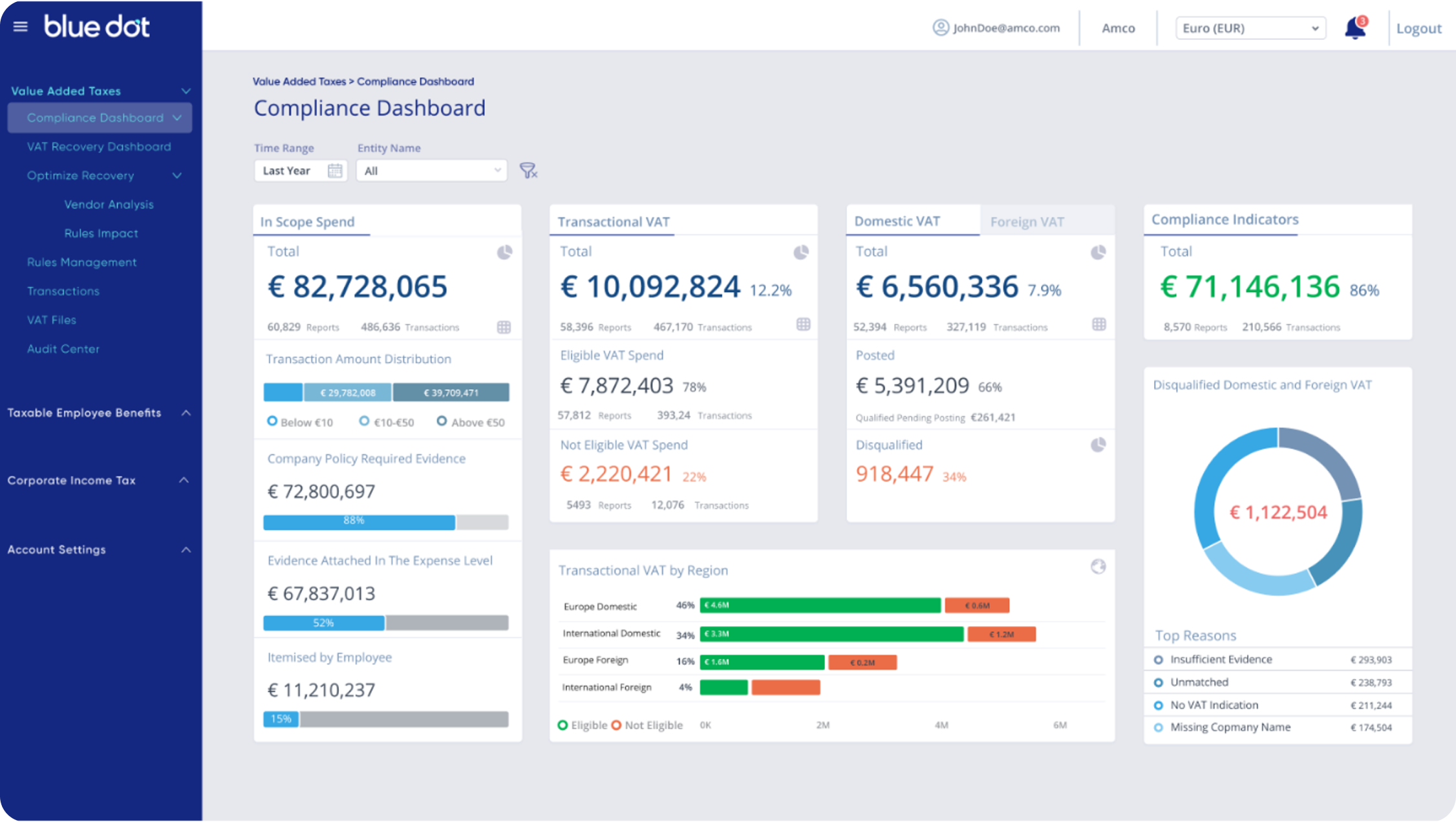

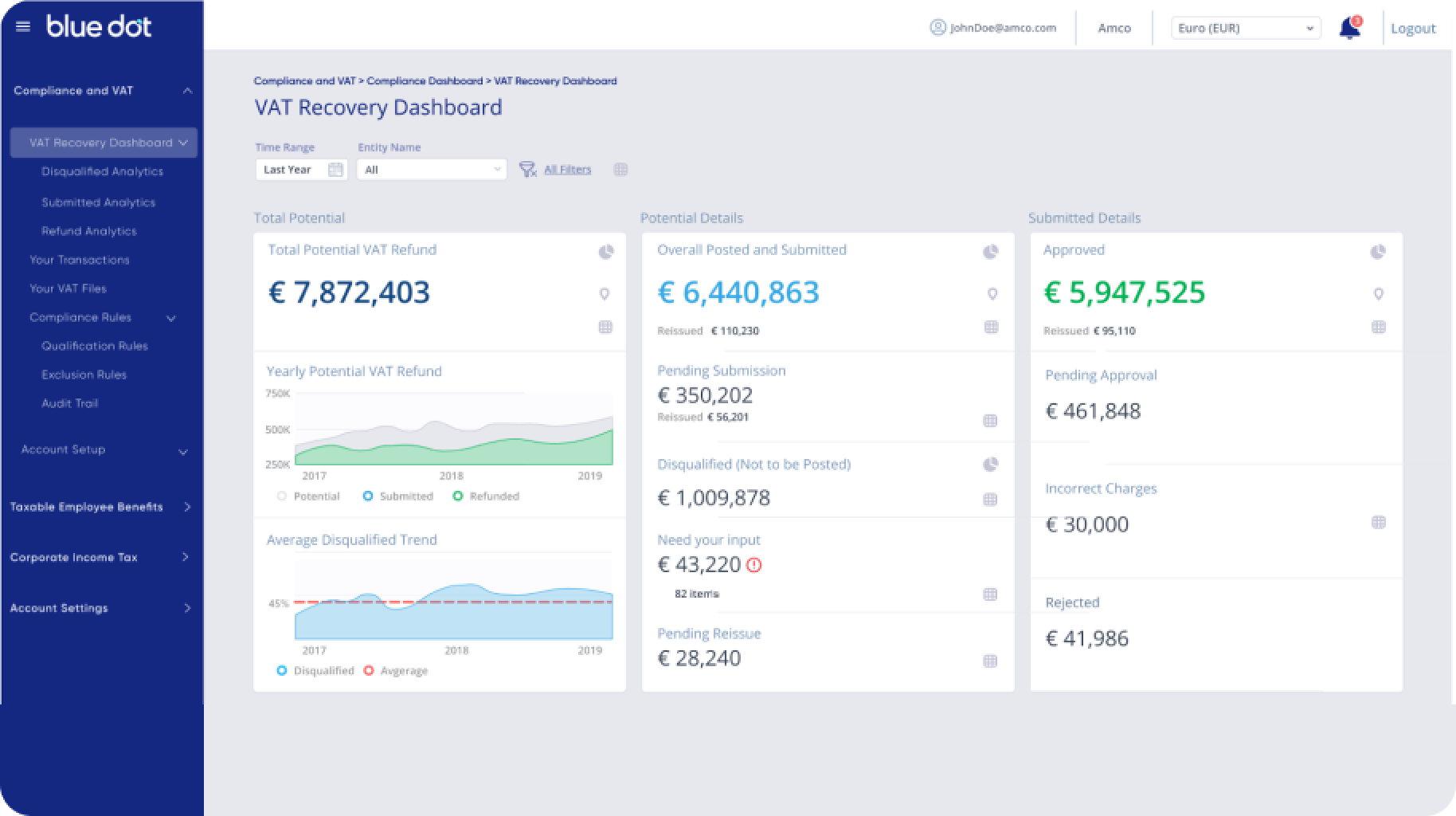

Automate & Maximise your VAT recovery

Our platform seamlessly processes domestic and foreign travel expenses, foreign VAT in Accounts Payable, as well as centrally billed TMC and procurement card expenses — all within a single, unified solution.

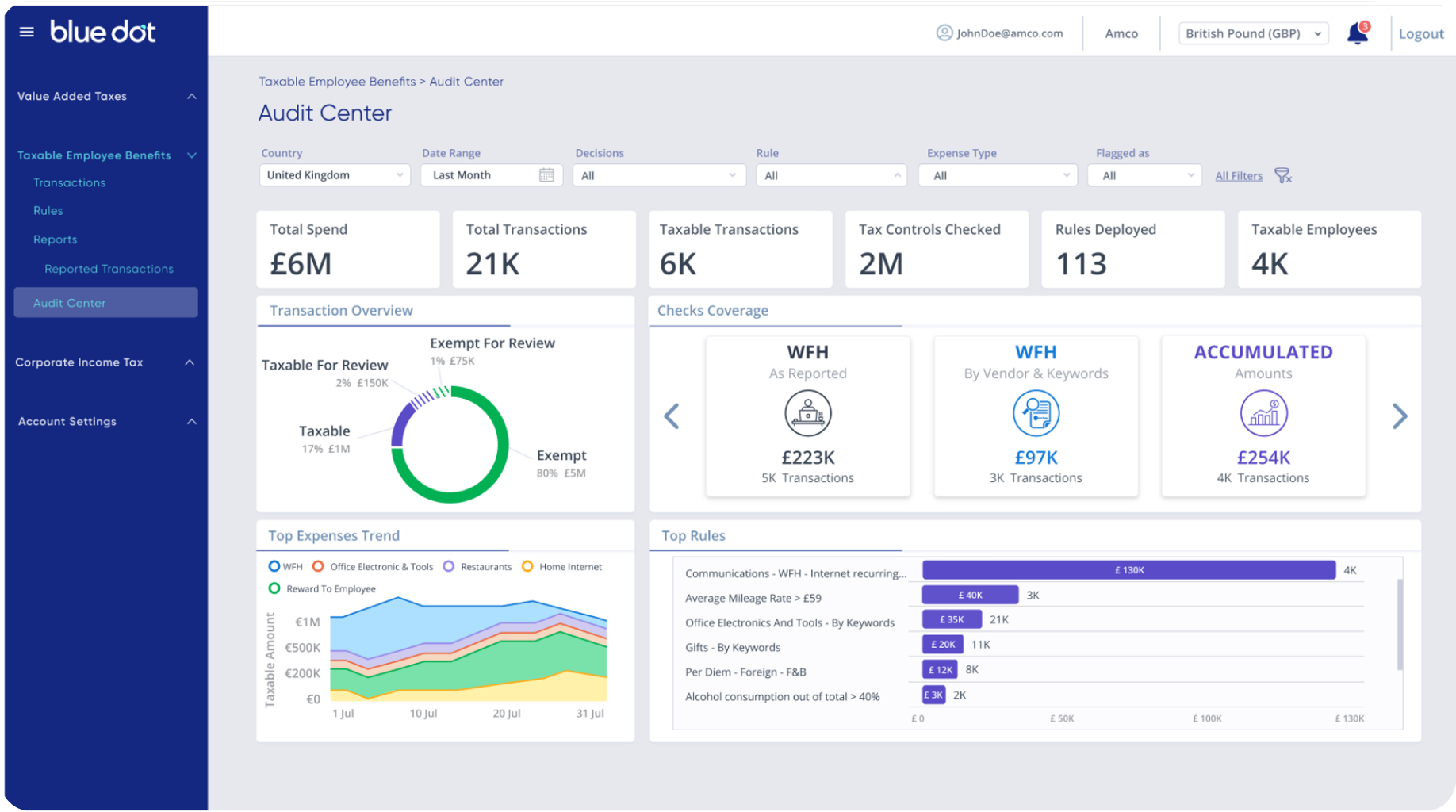

TAXABLE EMPLOYEE BENEFITS

Detect fringe benefits automatically in employee expenses

The Blue dot Taxable Benefits solution continuously analyses employee expense reports and receipt images to automatically identify items that must be reported as fringe or taxable benefits.

INSPECT

Detect fraud and enforce travel policy compliance automatically

Blue dot’s Inspect continuously analyses employee expense reports and receipt images to identify suspicious spend, errors, and potential fraud — automatically and at scale.

TAXABLE EMPLOYEE BENEFITS

Detects and analyses consumer-style spend that is subject to TEB (and required wage tax payment from the company or the employee) and impacts the wage tax report.

INSPECT

A scalable expense monitoring solution that analyses expenses, ensures compliance, optimises policies and detects fraud powered by AI and advanced rule-based analytics

The Employee Spend Compliance gap is disrupting tax compliance efforts for organizations worldwide

Data integrity is at harm: Incomplete data and missing procurement checks

23% of expense report items are incorrect for tax purposes. Incomplete mandatory data alongside missing checks and calculations are prolific, streaming through companys’ financial systems, jeopardizing data integrity.

Finance and tax teams are overloaded with manual labor

Finance teams must complete and validate missing information, understand each transaction, and apply country-specific tax rules while documenting the audit trail for authorities. This comes with endless hours of complex manual labor, messy Excel sheets and increased error rates.

Increased Compliance Risk

As purchase and expenditure controls shift away from centralized finance, errors and incomplete data are magnified as traditional checks and approvals are replaced with unstructured financial transactions. Small errors and inaccurate filings soon magnify into significant risk.

Blue dot’s platform helps you understand your employee expense and foreign AP transactions, while empowering finance & tax teams with effortless compliance, creating peace of mind and audit readiness, money is being brought back straight to your business.

“More and more, organizations are looking to technology advancements to cope with the ever-changing challenges of global business…

With a platform that offers coverage in both the VAT and taxable employee benefit spaces, Blue dot is positioned to address the new working norm in the post-COVID world.”

– Kevin Permenter

Senior Research Analyst at IDC

Our award-winning technology

The world’s leading organizations rely on Blue dot

“Blue dot effectively mitigated our high disqualification rate, increased compliance and maximised VAT reclaim opportunities.”

- James Nguyen

Global Head of Procurement for Zoetis

“We implemented Blue dot in over 24 entities, it's much easier and faster, and our refunds have increased significantly.”

- Charlotte Schellerup

Specialist Global VAT and Indirect Taxes, Vestas Wind Systems

“Blue dot VATBox transformed our process from a manual, decentralised workflow into a centralised digitised global process.”

- Jose-Manuel Pedron-Garcia

Global Tax Compliance Process Leader, Michelin

“Blue dot VATBox technology enables Dell to recover more VAT than we ever dreamed about.”

- Eoin Fitzgerald

Indirect Tax Director, Dell

“After a time-consuming audit by HMRC, Blue dot VATBox helped show HMRC that we're now in control of these expense claims.”

- Andrew Davis

Head of VAT at British American Tobacco

“With Blue dot VATBox and SAP Concur, we achieved optimal & compliant VAT returns. The results can be seen on our bottom line.”

- Kris Van Aken

Corporate Tax, Finance Service Manager, Atlas Copco

Modern employee spend is on the rise as the new normal

The world is witnessing an explosive growth of employee triggered transactions: Hybrid work, P Cards, decentralized purchasing and online consumption – employees are buying more than ever before – finance teams are left with the implications arising from the unstructured nature of those transactions.

Introducing the world’s leading AI tax compliance platform for modern employee spend

Optimised VAT outcomes in full compliance

Calculate and identify any eligible and qualified VAT spend along with countries’ tax regulations and company policy by leveraging an automated AI and ML-powered application to ensure a compliant domestic VAT posting and foreign VAT refund.

Full automation of the Taxable Employee Benefits review process

Enjoy the required level of checks, controls, and calculations of consumer-style spend subject to taxable employee benefits. Using an AI-driven application that analyses the spend that is subject to wage taxation or specific pay-as-you-earn reporting.