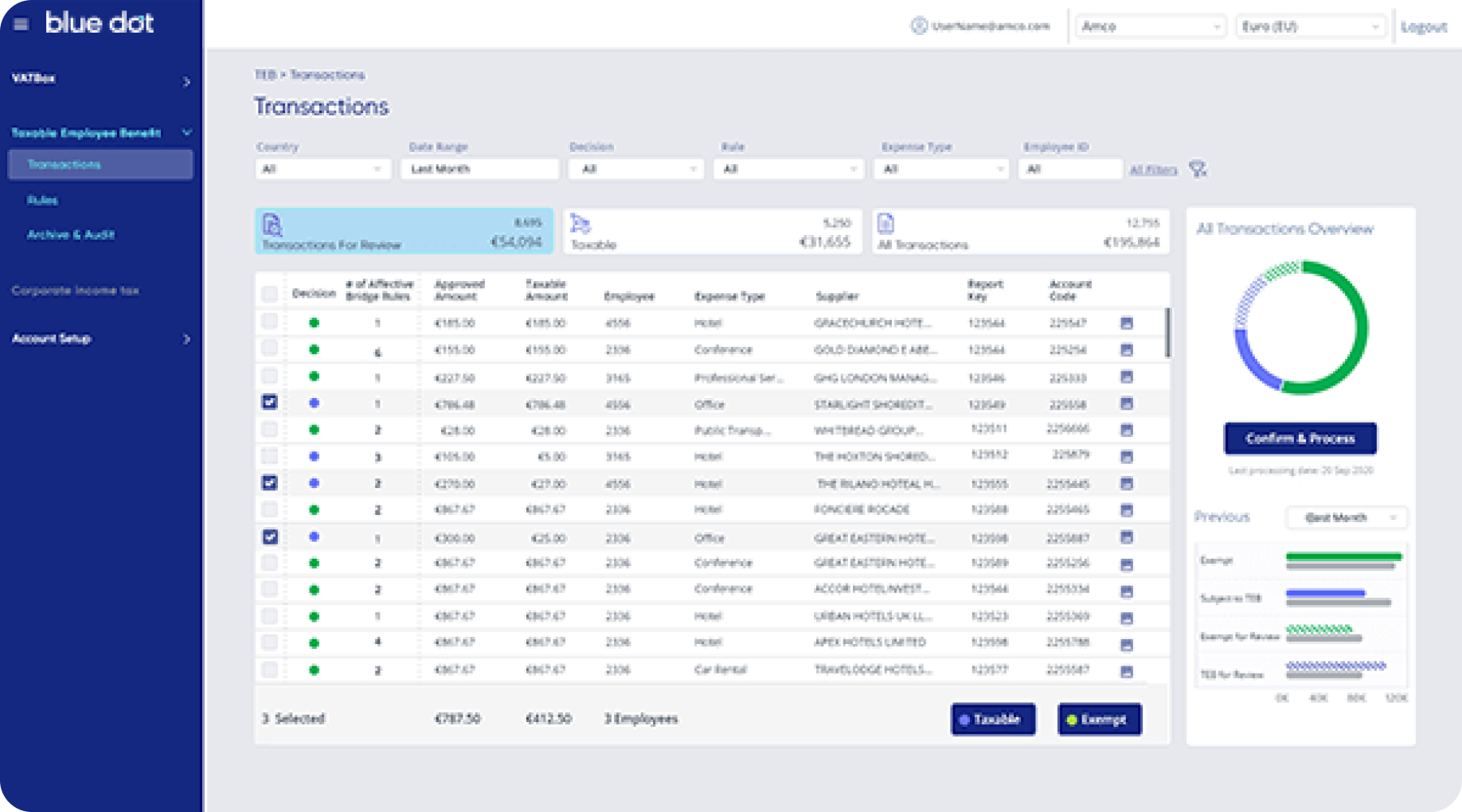

Simplify TEB compliance with minimal human intervention

Employers must report all Taxable Employee Benefits (TEB) that are part of an employee’s compensation package. Stay in compliance with the latest taxable benefits regulations by delivering the required level of checks, controls and calculations of consumer-style spend subject to TEB.

Compliance with minimal human intervention

- Reduce exposure, avoid compliance risk and gain complete visibility over employee taxable expenses

- No sampling: Supports processing of 100% of the employee’s expenses, fully integrated with SAP Concur & other systems

- Technology-driven OCR, auto-matching, and ML for deep analysis

- A simple and intuitive experience that does not require any special training

- Comprehensive Taxable Employee Benefits reporting capability per country

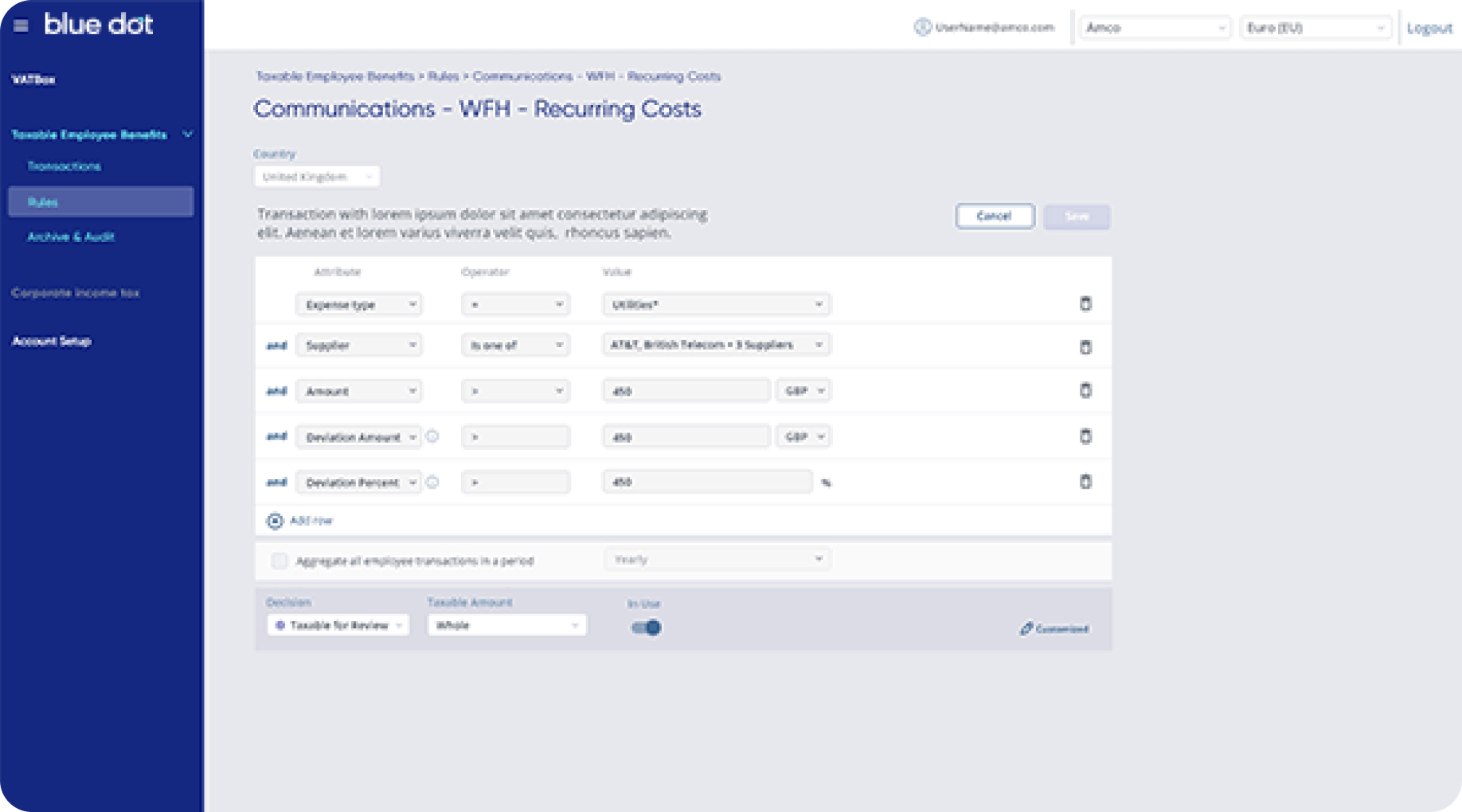

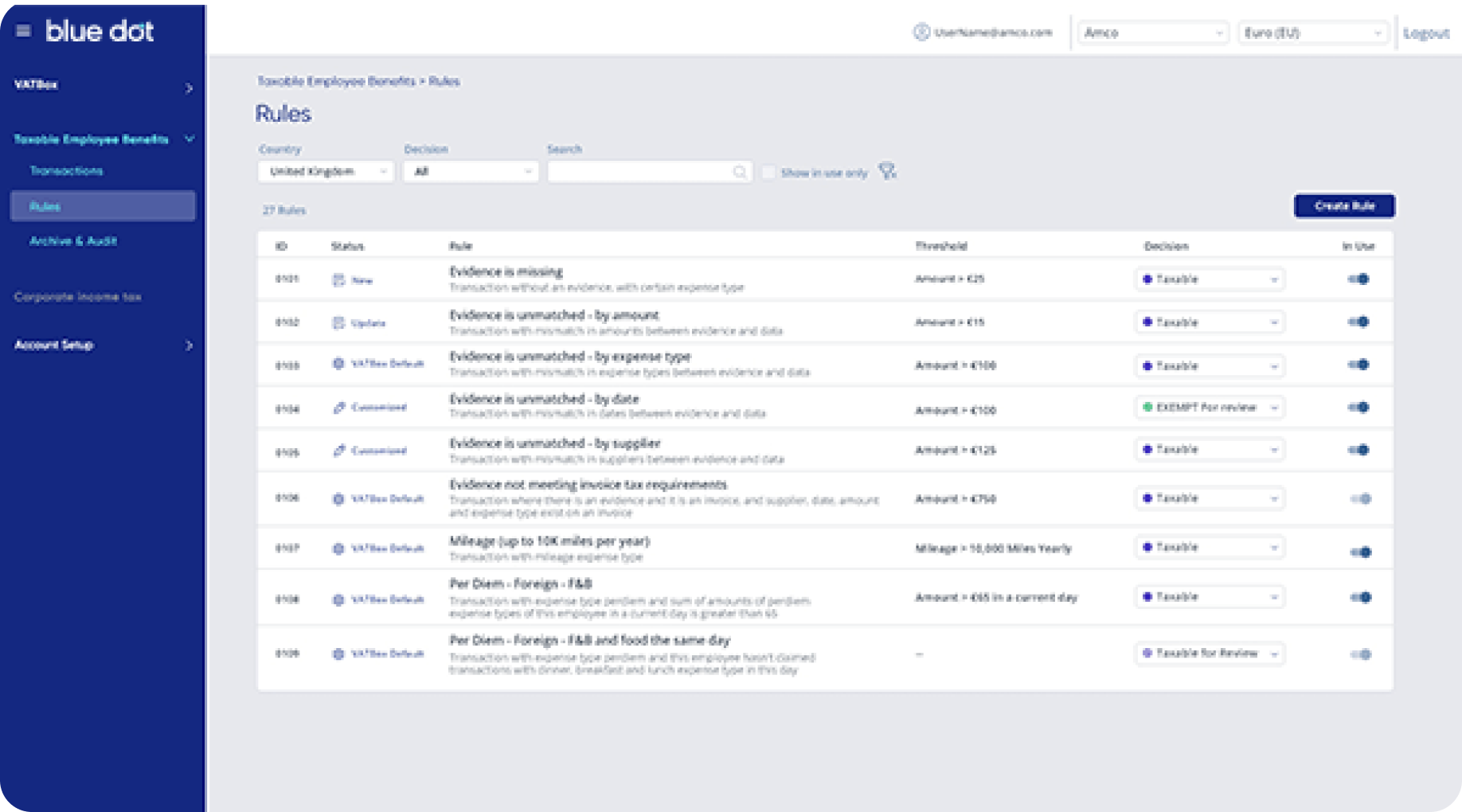

Taxation rules customised to your needs

- Tailor the taxation rules according to your specific corporate policies and requirements

- Gain full control over the level of automation, decide what type of transaction will be exempt or taxable automatically, and determine whether specific transactions should be marked for manual review

- Optimise the platform’s performance by setting rules that will fully automate the taxation process