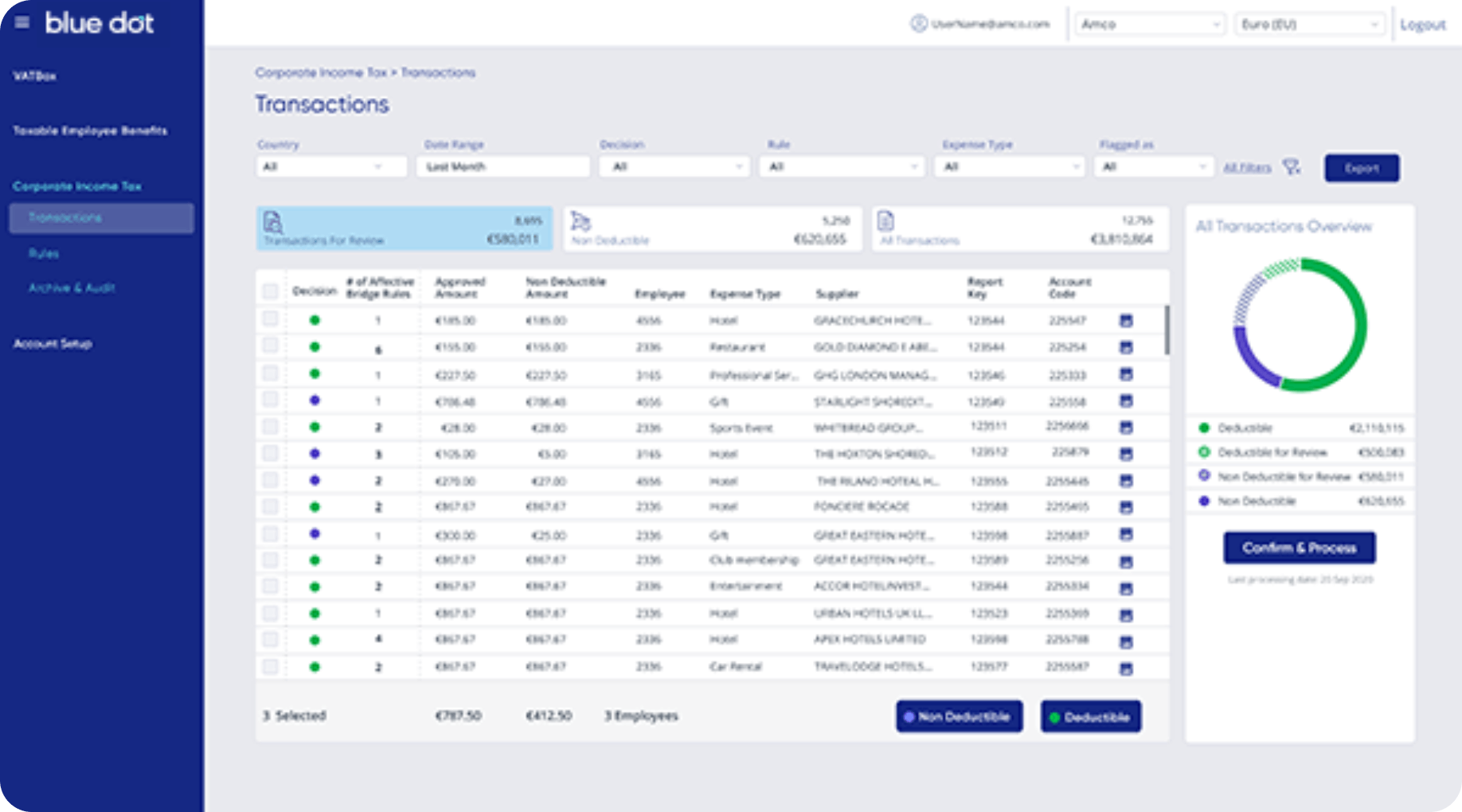

Customise taxation rules to suit your needs

Enjoy the required level of checks, controls and calculations of consumer-style spend which is disallowed to deduct from your taxable profits. Using an AI-driven application that analyses which part of the spend should not be considered to be “wholly and exclusively” for business purposes.

Compliance with Minimal Human Intervention

- Reduce exposure, avoid compliance risk and gain complete visibility over disallowed (non-deductible) employee expenses

- No sampling: Supports processing of 100% of the employee’s expenses, fully integrated with SAP Concur & other systems

- Technology-driven OCR, auto-matching, and ML for deep analysis

- A simple and intuitive experience that does not require any special training

- Comprehensive reporting clarifying the non-deductible amount per each expense

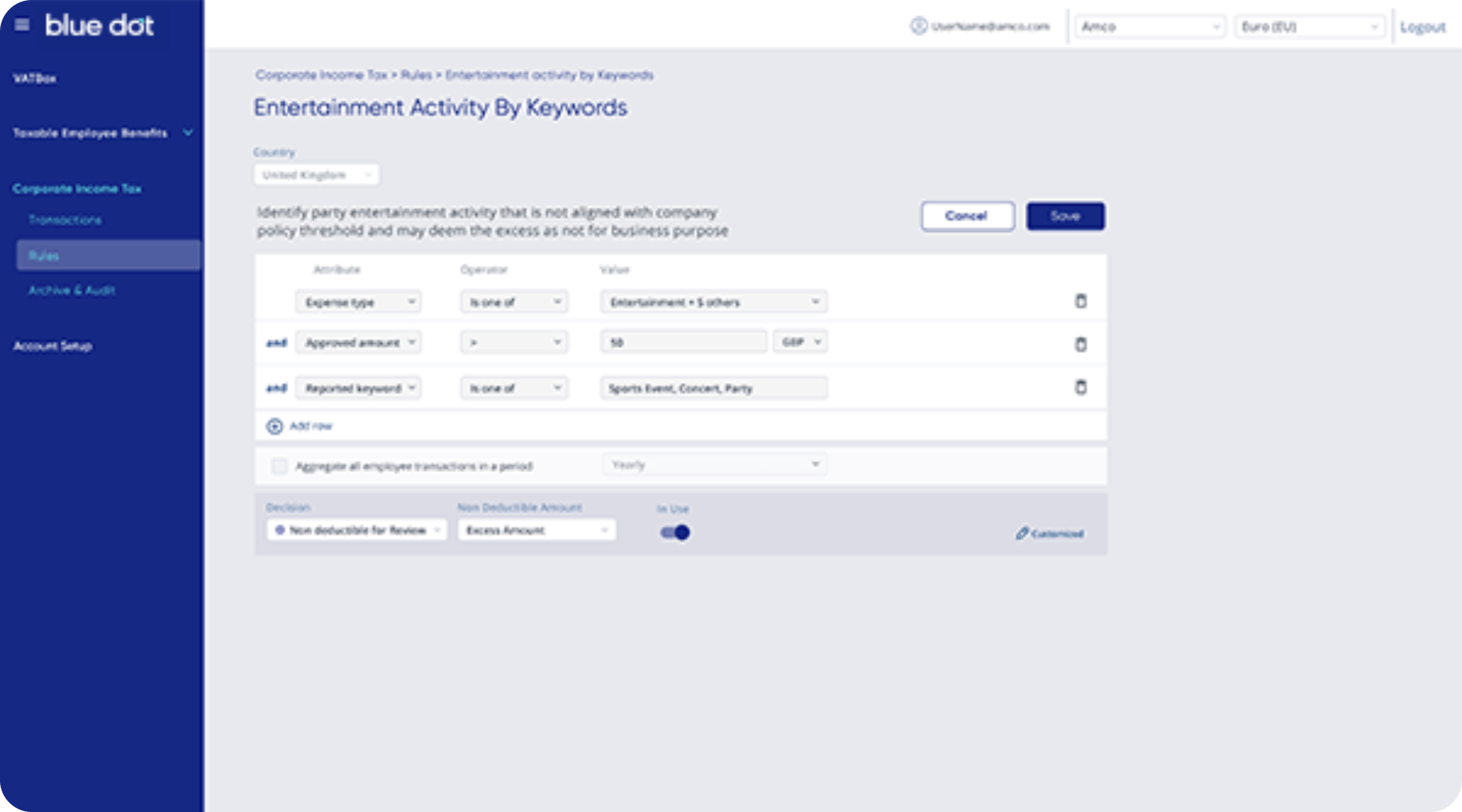

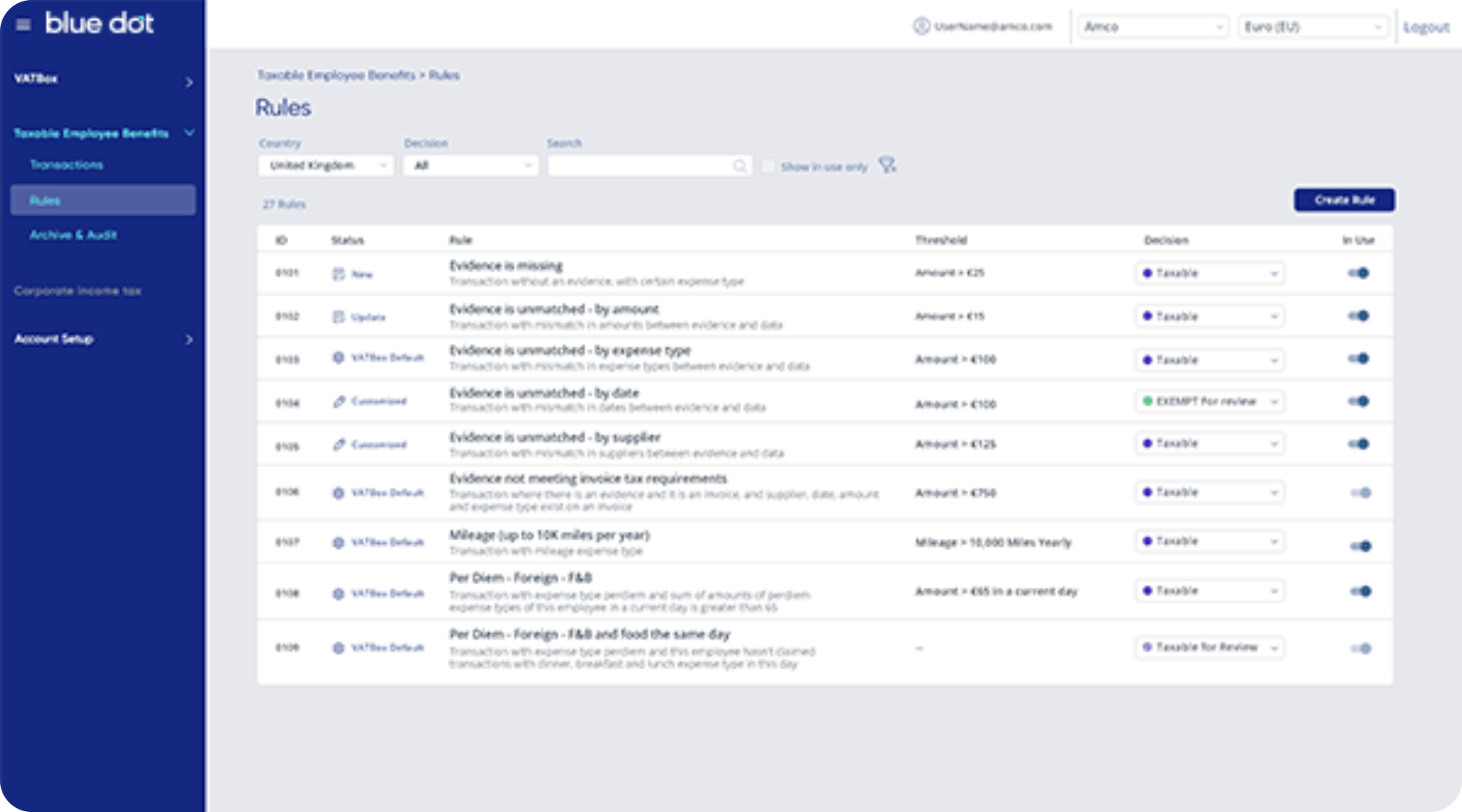

Best-in-Class Taxation Rule Engine

- Enhanced and up-to-date taxation rules per each supported country

- Advanced and innovative capabilities to examine any aspect of the expense including evidence data analysis

- Best practices and automatic rule changes delivery

Taxation Rules Customised to your Needs

- Tailor the taxation rules according to your specific corporate policies and requirements

- Gain full control over the level of automation, decide what type of transaction will be deductible or non-deductible automatically, and determine whether specific transactions should be marked for manual review

- Optimise the platform’s performance by setting rules that will fully automate the taxation process