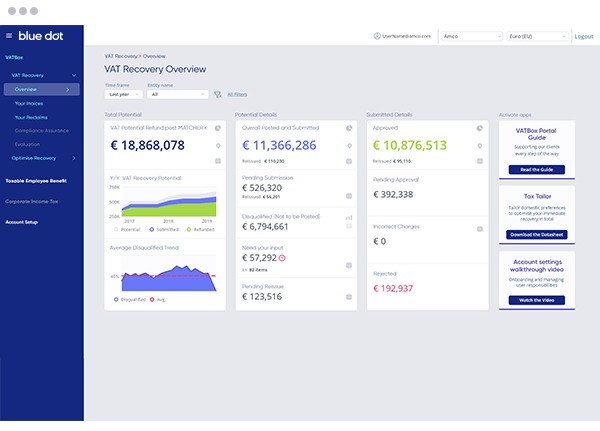

VAT assurance powered by VATBox

- Benefit from a breakdown of your invoices and VAT reclaims, and gain an in-depth overview of all VAT reclaim statuses

- Easily navigate to the different sections of the VATBox Portal to gain insight into your transactional data and VAT submissions

- Exploit the available business applications to optimise and increase your VAT recovery potential

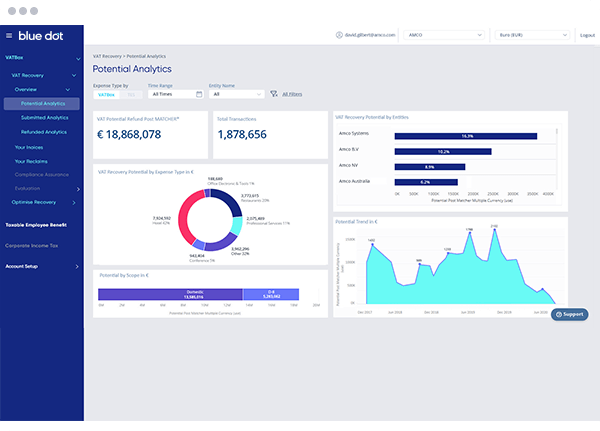

VAT Potential Analytics

- Gain insights based on past trends of submitted VAT refund requests vs actual refunded VAT

- Benchmark your company against your industry average number of disqualified requests

- Compare invoice data with expense records to determine their validity using Blue dot Matcher®

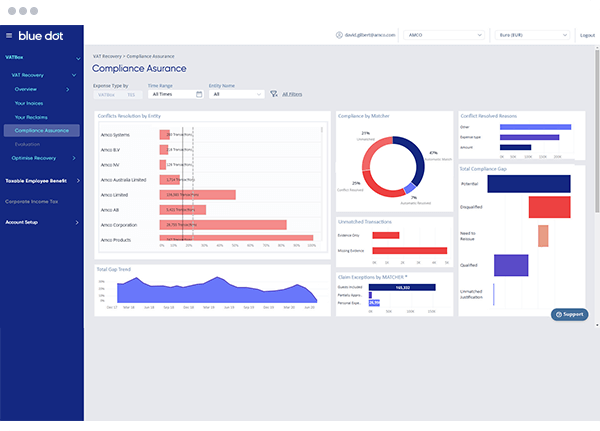

Compliance Assurance

- Gain insights into gap trends and learn where to focus your compliance efforts based on previous conflicts

- Ensure the highest compliance rate by using our triple QA mechanism to extract, match and analyse every invoice

- Leverage powerful analytics and actionable insights that support informed data-driven decisions while ensuring full compliance with tax and financial authorities

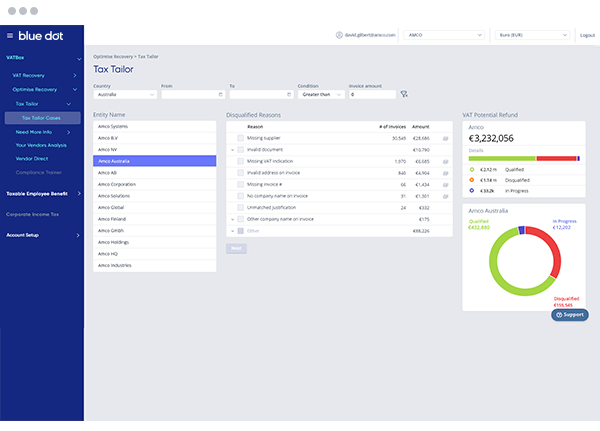

Tax Tailor

- Optimise your domestic VAT recovery potential and boost your savings

- Adjust the strictness of your domestic VAT/GST returns based on your company policy and rulings with the tax authorities while maintaining full compliance

- Reduce risks and improve compliance by resolving inquiries with minimal intervention

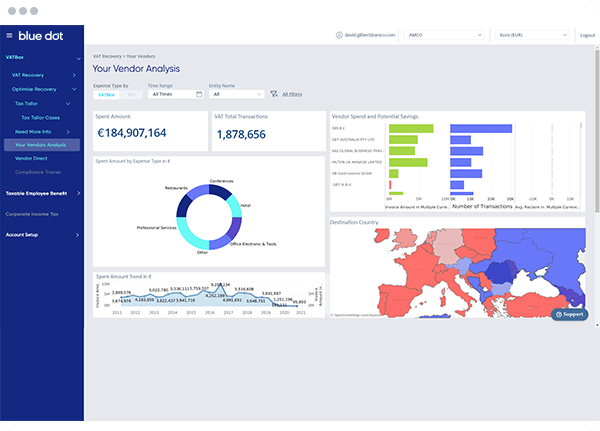

Vendor Analysis

- Gain a clear view of your vendors’ performance, broken down by expense types and spend trends

- Understand who your top vendors are, based on the number of transactions, amounts spent, and overall performance

- See the distribution of your spend amounts by destination countries