Blue dot

Beyond tax compliance in the end user payment era

The ability to connect the dots and complete the transactional story

Reduce tax vulnerabilities for consumer-style spend across the enterprise

Driving tax digitalisation with robust, user-friendly solutions

When businesses are driven by end-user transactions

The promise of control, in the face of data chaos

To be the gift of calm, to the end-user financial storm

Digital tax compliance

Technology first

Always updated

Audit-proof

Tax Compliance Platform:

Centralised, Standardised and Digitalised Tax Compliance Services

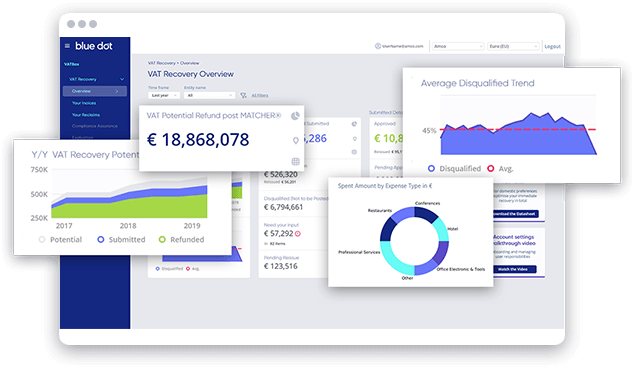

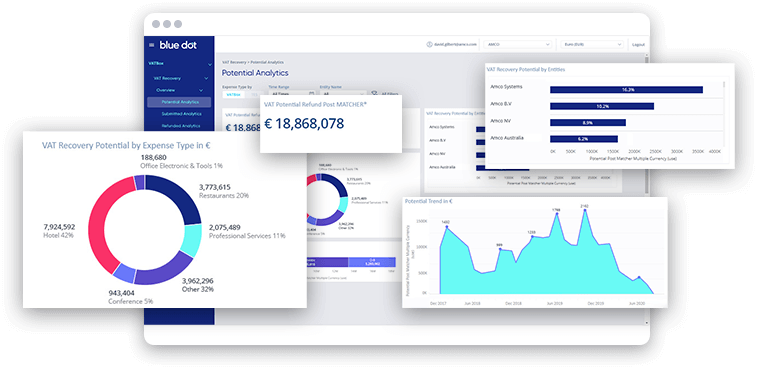

Optimised VAT outcomes in full compliance

Calculate and identify any eligible and qualified VAT spend along with countries’ tax regulations and company policy by leveraging an automated AI and ML-powered application to ensure a compliant domestic VAT posting and foreign VAT refund.

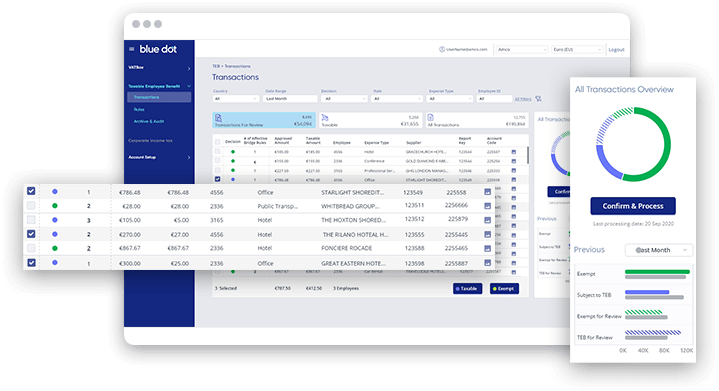

Full automation of the Taxable Employee Benefits review process

Enjoy the required level of checks, controls, and calculations of consumer-style spend subject to taxable employee benefits. Using an AI-driven application that analyses the spend that is subject to wage taxation or specific pay-as-you-earn reporting.

Compliance with minimal human intervention

Control all consumer-style spend calculations that are subject to CIT (not considered a business expense for CIT purposes) using an AI-driven application that provides the required level of checks to accurately impact the CIT and payment reports.

The world’s leading enterprises rely on Blue dot

“Blue dot effectively mitigated our high disqualification rate, increased compliance and maximised VAT reclaim opportunities.”

James Nguyen, Global Head of Procurement for Zoetis

![]()

“We implemented Blue dot in over 24 entities, it’s much easier and faster, and our refunds have increased significantly.”

Charlotte Schellerup, Specialist Global VAT and Indirect Taxes, Vestas Wind Systems

![]()

“Blue dot VATBox transformed our process from a manual, decentralised workflow into a centralised digitised global process.”

Jose-Manuel Pedron-Garcia Global Tax Compliance Process Leader, Michelin

“Blue dot- VATBox Technology enables Dell to recover more VAT then we ever dreamed about.”

Eoin Fitzgerald, Indirect Tax Director, Dell

“After a time-consuming audit by HMRC, Blue dot VATBox helped show HMRC that we’re now in control of these expense claims.”

Andrew Davis, Head of VAT at British American Tobacco

![]()

“With Blue dot VATBox and SAP Concur, we achieved optimal & compliant VAT returns. The results can be seen on our bottom line.”

Kris Van Aken, Corporate Tax, Finance Service Manager, Atlas Copco

Our award-winning technology