Challenges

Inefficient & complex invoice validation posed by multiple EMS systems

Lack of resources and knowledge to cover VAT rules around the globe

Risk and exposure due to incomplete, error-prone manual processes

Results

Optimised VAT recovery process - Fully digitalised

60% higher level of compliance & reduced audit risk

Over 5,000 workforce hours saved due to enhanced operational efficiency

Full visibility and insights via a centralised workflow

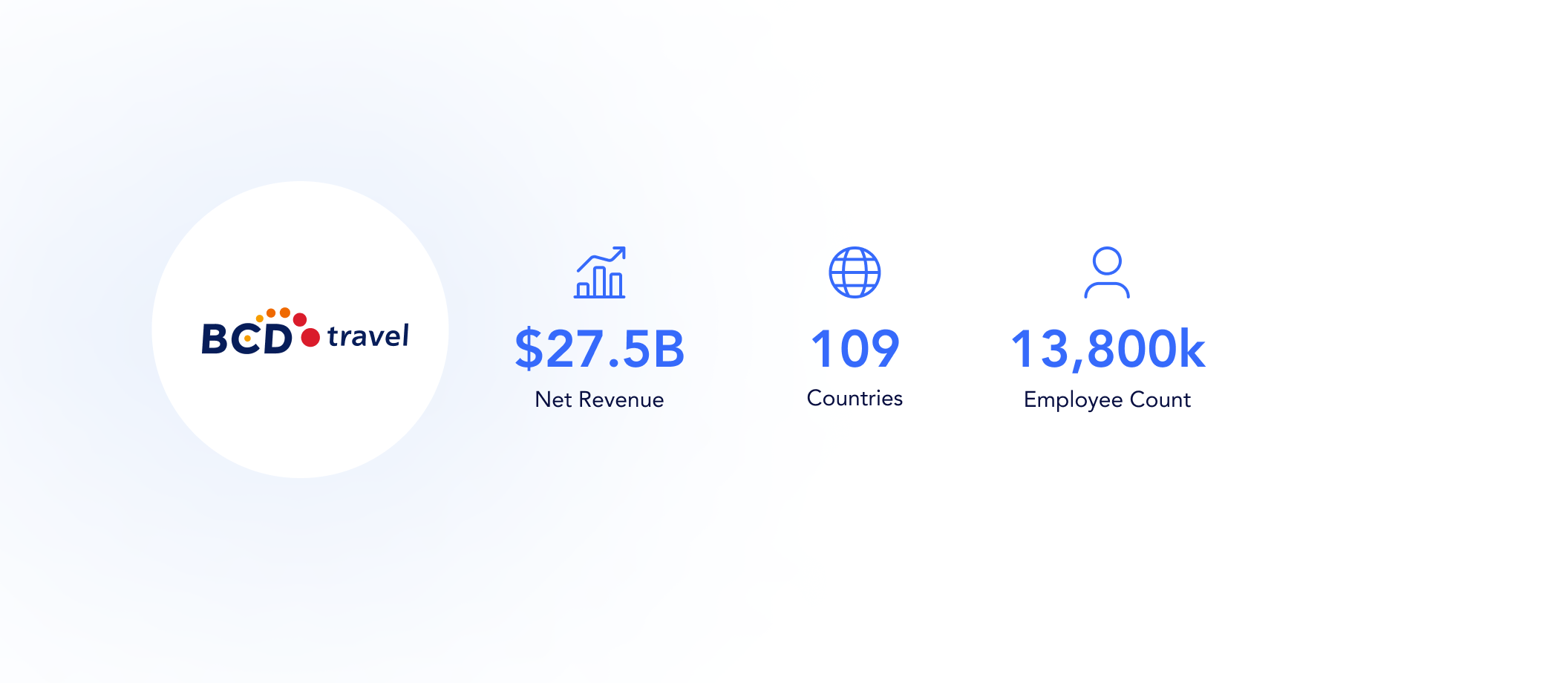

BCD Travel was seeking to streamline their VAT recovery and compliance, but multiple expense management systems were not capable of accurately validating invoices and expense reports for VAT eligibility, increasing exposure and compliance risks. After implementing Blue dot’s AI-driven VATBox solution, BCD Travel gained a fully digitalised, centralised and audit-ready VAT recovery process across all their entities, allowing them to optimise reclaims, elevate compliance, and save over 5,000 workforce hours per year by streamlining their workflows BCD Travel is the third largest travel management provider in the world. The company has three main business lines: corporate travel management, travel program optimisation, and events management. BCD Travel is headquartered in the Netherlands, operates in 109 countries, has $27.5 billion in total 2019 sales and a combined worldwide workforce of 13,800. The company’s mission is to help their clients travel smarter and achieve more by providing travellers with innovative tools that keep them safe and productive and guide them in making good choices on the road. BCD Travel faced difficulties in obtaining visibility and insights into their VAT recovery and compliance on domestic and foreign Travel & Entertainment (T&E) invoices. The global tax team faced the complexity of multiple expense management systems, and a lack of resources and knowledge to cover VAT rules around the globe. The expense systems in place were not capable of processing invoices and validating them for eligible VAT refunds at the same time, resulting in BCD recovering only a fraction of its eligible VAT. Moreover, the volume of employee-generated expenses was simply too high a burden for a full manual audit process.. Please enter your details below to access the full case study

Challenges

Results

Overview:

Leveraging our Generative AI beyond expense and tax compliance

The Company

The Challenges: Multiple EMS Systems Bring Complexity, Risk & Strain on Internal Resources