Choosing the Right AI Tax Software: Full AI-Led Automation for Optimal VAT Outcomes

The Blue dot Team

The Blue dot Team

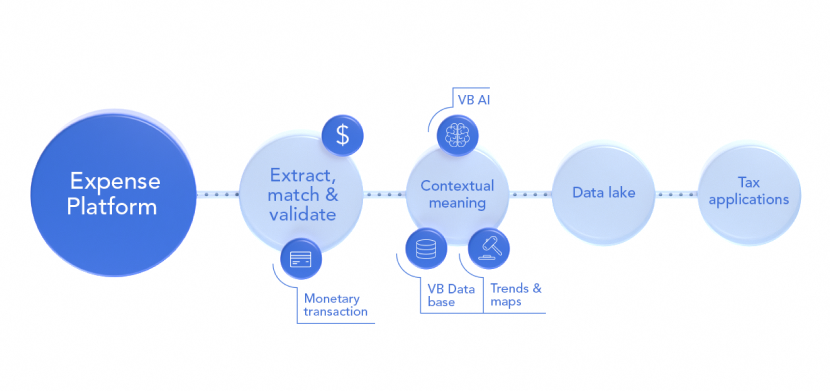

The scale and level of complexity enterprises face today in understanding their T&E expense data demands advanced and intelligent solutions that put the focus on data quality and control – But these challenges have eclipsed the capabilities of incumbent market solutions. Current providers in the expense, tax, and VAT management spaces do not fully employ an AI-led approach that allows a deep and contextual understanding of each transaction and expense report. This also makes fixing the glaring gaps in data quality and integrity impossible, which is why VAT tech providers to date still patch together their offerings by combining partially automated transaction analysis and manual processing.

In our recently published VAT Technology Guide we dive into the challenges global finance and tax departments are facing in managing their employee-driven expenses, and the capabilities they need in a VAT solution to meet increasingly stringent VAT reporting and compliance regulations while allowing them to recoup the maximum amount of VAT across their entities.

In 2023, only a full, contextual, and transparent transactional story can enable Finance and tax departments to assess the business justification of an expense, uncover anomalies that lead to non-compliance of company policies and tax regulations, and illuminate clear savings opportunities. An AI-led approach that focuses on data quality is vital to provide finance and tax leaders with the level of reliability they need to review their company’s VAT opportunity, understand with certainty which transactions are eligible for VAT reclaim, and the key causes of disqualified claims so that they can optimise their process and realise optimal outcomes to all aspects of their business.

Performing this at the scale and pace of today’s real-time digital reporting requirements demands an approach led by AI-led analysis that automates and centralises all data and processes on a centralised platform.

It’s important to take the time to review and examine these critical factors:

Enterprises can transform their entire VAT management process today with advanced innovations that deliver levels of efficiency, control, and compliance not possible before.

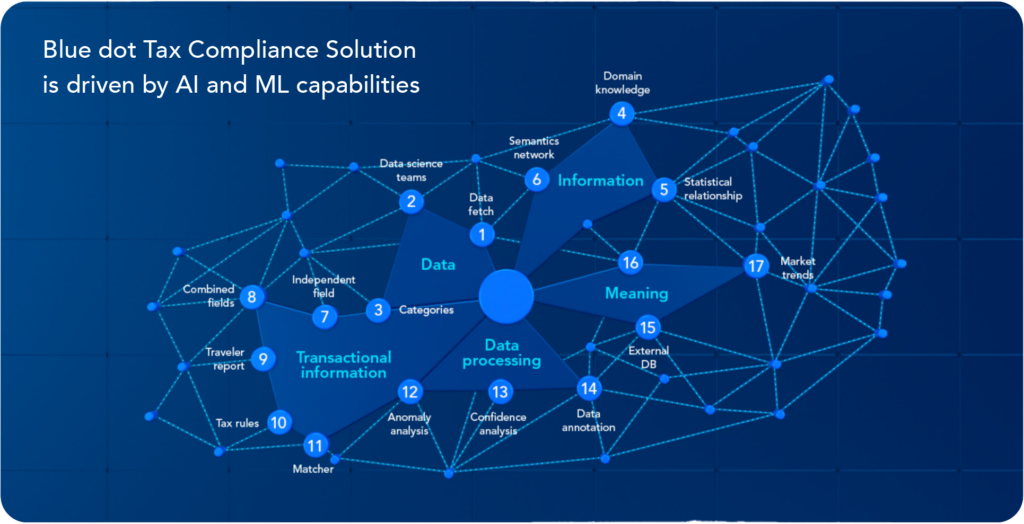

Blue dot has developed the only technology-driven platform that brings leading edge Generative AI capabilities to the tax management space. Blue dot’s VATBox solution uses an advanced Hybrid AI approach that combines over 200 AI and machine learning models, including a suite of Generative AI models developed specifically for the precision and control of tax data required in VAT management. These advanced AI models are combined with deep tax expertise to simplify compliance across all jurisdictions and optimise VAT recovery potential for global enterprises.

Here’s how the Blue dot platform orchestrates AI-based data generation to bring new levels of efficiency and control to VAT management:

This deep commitment to the highest level of data quality and expense analysis is core to what sets Blue dot’s technology apart in the tax management space and enables businesses to scale VAT management with unprecedented speed, efficiency, and confidence:

Global enterprises are already taking the burden and risk out of their VAT reclaims and:

By making compliance effortless with Blue dot’s standardised and centralised platform, enterprises can scale their foreign and domestic VAT recovery processes with trust and confidence while maximising refunds and optimising cost savings.

Download the full enterprise VAT Technology Guide to learn how moving to an advanced AI-driven and centralised VAT management process can give your business the control and insights it needs to optimise both VAT recovery and compliance in parallel.

* Mandatory Fields