[Guide]: How Can Enterprises Optimise VAT Recovery & Compliance with Advanced AI?

The Blue dot Team

The Blue dot Team

![[Guide]: How Can Enterprises Optimise VAT Recovery & Compliance with Advanced AI?](https://www.bluedotcorp.com/wp-content/uploads/2023/12/Blog1-No-text.png)

Changing regulatory and market challenges in today’s digital economy have made technology-driven VAT management essential for indirect tax and VAT managers.

Why? Legacy tools and platforms that only partially automate the processing of your VAT invoices and receipts are not capable of understanding the nuances and context of so many employee-generated expenses, resulting in data gaps and error-prone manual checks that lead to disqualified claims and increased audit and non-compliance risks.

Finding and implementing a technology-driven solution that intelligently and accurately analyses invoices and expense reports for eligible VAT refunds, automates high-volume and low-value manual tasks, and enables accurate, transparent, and auditable record-keeping and submissions helps global enterprises to optimise recovery while meeting digitalised reporting and compliance requirements.

Our new VAT Technology Guide dives into advanced breakthroughs in artificial intelligence (AI) and how they can solve the data problem at the core of expense analysis and reporting. By ensuring the highest level of data quality and transparency, global finance teams can speed efficiency, reduce human errors and disqualified claims, minimise audit risks, and simplify the VAT management process end-to-end.

VAT recovery processes have been dramatically impacted by new remote and hybrid workplace realities, consumer-style business spend, and constantly evolving tax reporting requirements around the world, presenting 3 major challenges for VAT and Indirect Tax managers:

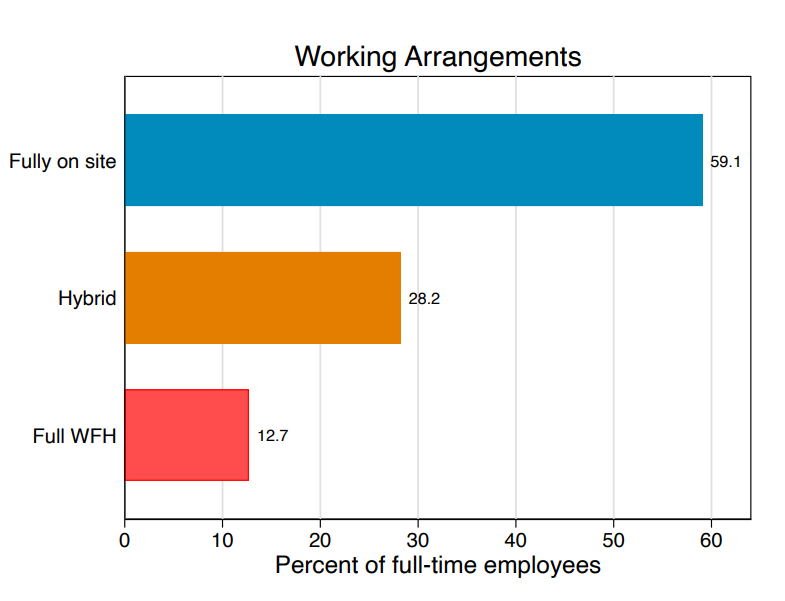

While remote and hybrid work models were already growing before COVID-19, the pandemic’s impact has rapidly accelerated these realities for enterprises and is here to stay. WFH Research shows that as of 2023, 12.7% of full-time employees work from home, while 28.2% work in a hybrid model.

Source: WFH Research

This has led to more online purchases being made by employees than ever before and new spend channels and sources such as P-cards outside the direct control of accounting, Accounts Payable (AP) and Payroll departments.

Finance teams must cope with the unstructured nature of these transactions which compromise their data from the very start, and are typically flooded with thousands of invoices and receipts with missing, incomplete or incorrect mandatory data. In fact, 42% of employee spend submitted for VAT/GST reimbursement does not meet compliance requirements due to incorrect information and missing data.

Regulators and tax authorities are increasingly implementing mandatory e-invoicing, e-audit, and real-time reporting requirements. Typical Expense management systems (EMS) still necessitate manual checks to validate invoices and reports for eligible VAT refunds which are impossible to control at a scale. These manual processes are slow, inefficient and error-prone – and fail to provide the complete digital audit trail tax authorities require. This increases audit exposure and non-compliance risks for businesses.

Tax rates and VAT eligibility rules vary significantly by expense type and are categorised and interpreted differently from country to country. Many businesses manage multiple, siloed expense management systems and ERPs. These decentralised processes prevent complete visibility and unified control needed to efficiently and accurately stay on top of VAT rule changes across different regions and entities.

Add together the evolving realities of both our work and personal purchasing behaviour, systems that lack precision and are not fully automated, and ever-changing tax rules across jurisdictions and you get significant complexity and a data quality problem that produces complex, inefficient, and non-compliant VAT reporting processes that invite severe consequences from global tax authorities such as fines, loss of credibility and financial losses.

Businesses are recognising these risks and realising the need for complete control of their expense data and an inherently digital audit-ready process:

The only truly AI-driven, centralised, and audit-ready platform built for global enterprises, Blue dot has developed VATBox – a unique generative AI solution built to solve the data problem at the heart of VAT management processes and enable them to meet today’s digitalised tax reporting obligations – ensuring effortless compliance and optimised recovery.

Combining over 200 AI and machine learning models and Generative AI capabilities, the Blue dot platform was explicitly made for the precision and control required for financial data management functions such as VAT management. These advanced AI models are combined with a built-in tax compliance engine to contextualize employee-driven expenses and precisely calculate VAT refund eligibility from each and every transaction. This enables enterprises to simplify compliance across all jurisdictions and optimise their VAT returns at scale.

Global Fortune 1000 companies are leveraging Blue dot’s centralised and digitalised platform to:

Download the full enterprise VAT technology guide to learn the must-have requirements an effective digitalised solution must deliver and how this can transform your VAT recovery and compliance.

* Mandatory Fields