Unleash the Power of AI Tax Technology for Employee Expenses Analysis

The Blue dot Team

The Blue dot Team

Covid is now behind us, but the world – and implicitly the business world – isn’t where it was two years ago. Moreover, the old reality is very unlikely to return.

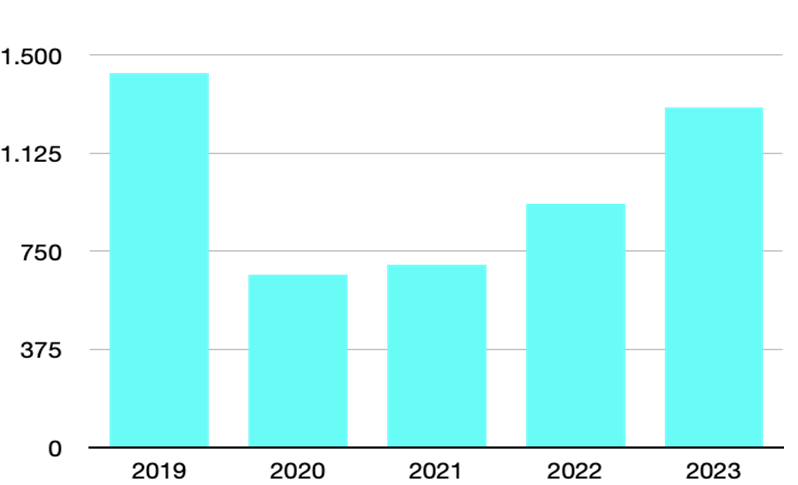

If we look at business travel, for example – this was one of the types of expenses that dropped the most after Covid hit. Now we see that business travel is picking up again, although it’s not yet at pre-pandemic levels, and it will probably need 1-2 more years to get there. But it’s an important trend that we see happening.

Global Business Travel Spend (Billions of Dollars)

Source: GBTA

The article is taken from a recent webinar that we conducted with one of our partners.

Watch it on-demand right now!

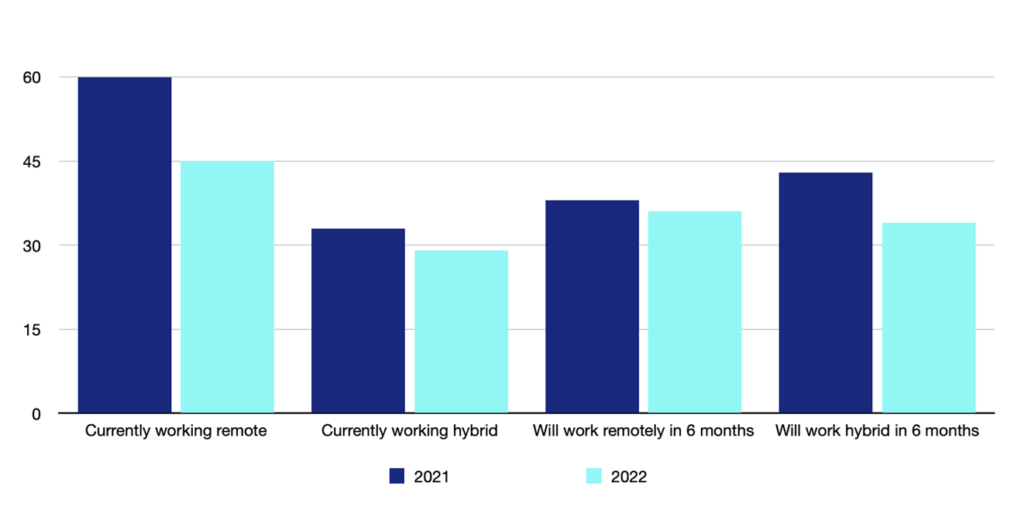

Another big change we’re seeing now – maybe even bigger and more significant than the business travel revival – is the switch from onsite to remote or hybrid work. Both options are still very popular, and will likely continue to be, as workers aren’t hurrying to return to offices.

In fact, if we look at the numbers, almost 75% of workers are now working remotely or in hybrid arrangements, and this trend is expected to continue.

Remote and Hybrid Work Trends

Source: Statistica

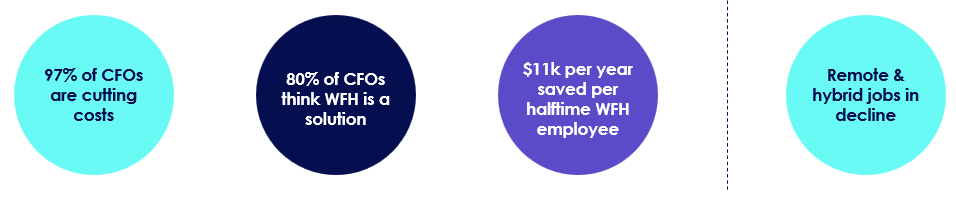

On top of these two changes in how and where employees work, there’s the recession wind blowing heavier and heavier across the EU. The baseline forecast is for global economic growth to slow from 6.1 percent in 2021 to 3.2 percent in 2022.

So with a likely recession ahead, CFOs have cut costs high on their agendas and agree that remote and hybrid work models might be a good solution for reducing expenditure.

Global Workplace Analytics did a study that showed that companies could save up to $11k per halftime WFH employee, which is significant in the current context.

Now you might wonder – if remote working provides such great benefits to both employers and employees, and could lead to such major savings, why isn’t everyone embracing it?

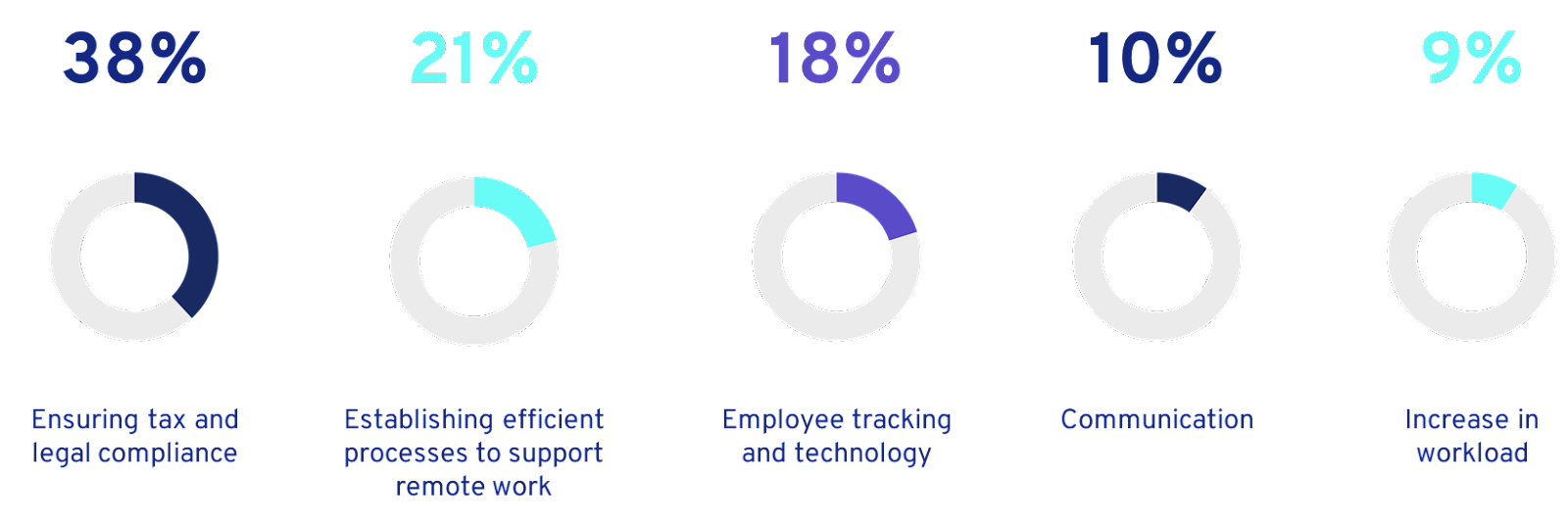

The most likely answer is the financial complexities caused by remote and hybrid work, especially when it comes to employee expenses.

38% of companies are worried about the legal and tax implications of such work arrangements.

So of course, some might think that remote and hybrid work is a great way to save money for companies, but the reality is that it’s more than just allowing people to work from home.

And for finance teams, it can actually make things very complex. The more scenarios you allow as an employer, the more complexities you have when it comes to employee expenses and tax implications.

We now see that authorities either go back to the old rules or implement new rules to deal with these new forms of working. In any event, it keeps our tax team busy, since it is their responsibility to make sure that all our system rules are always up-to-date and that is global.

We see that same challenge with the finance and tax teams of our clients. They need help keeping up to date with keeping track of all changes in the different countries.

Source – KPMG

“Remote” and “hybrid” work arrangements definitely have advantages, but things are a bit more complex than just employees changing their work location.

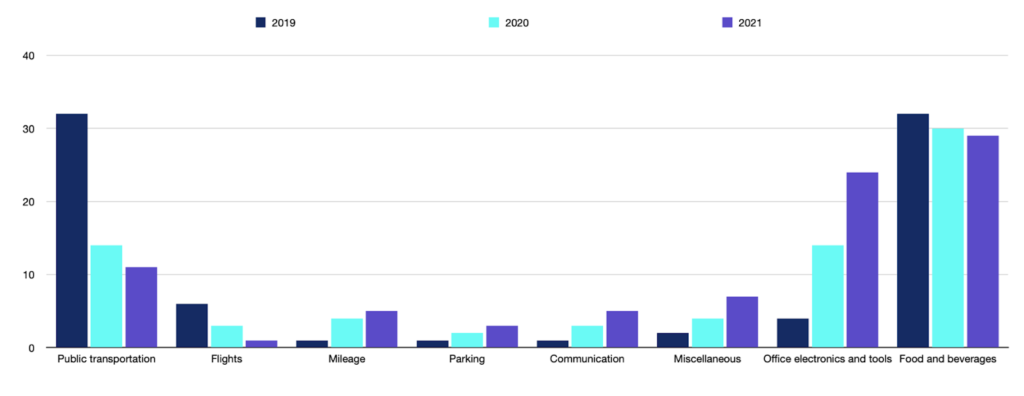

When looking at expenses, it makes sense to requalify some of these expenses in specific categories that better fit tax purposes. For example, people are taking the car for commuting, which shows a decrease in public transportation, but an increase in mileage and parking.

Employers started reimbursing home internet bills, which feeds into the communication bucket. And the always challenging category of “miscellaneous” or ‘other” is for tax and finance people, the one category that is usually in their top 5 to run analysis on.

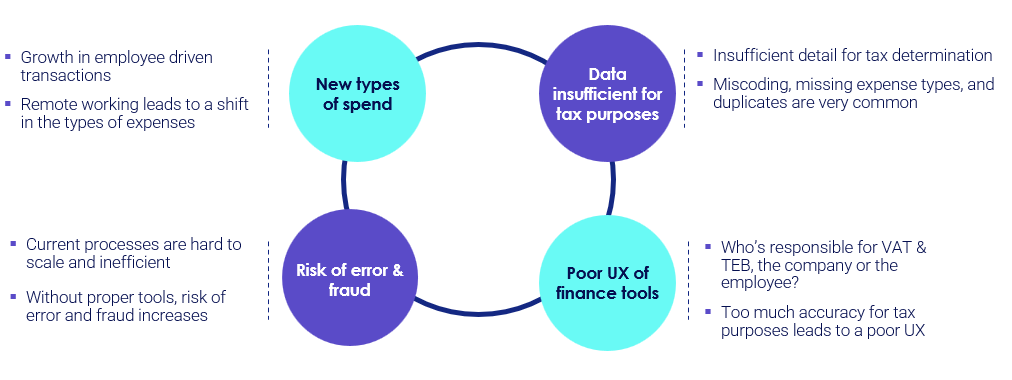

Now when trying to solve that issue we come to the dilemma of wanting and needing more information on the transactional level from a tax & finance perspective, but you want to avoid extra complexity for the employee.

No company wants to put the burden that comes from this change in spending on their employees. They should continue working and filing expenses the way they are used to, and the extra complexities should be handled automatically by technology.

When employees submit these expenses, miscoding the expense type is very easy because sometimes the more granular expense types are missing. What we typically see with customers is that they have 30-80 expense types set up in the system.

But if you’d really want to be accurate and rely only on the records submitted by employees, you’d need 300 expense types, not 30. Because you’d have variations such as:

Finding out what kind of “Parking” is expensed is necessary to arrive at the proper employee/fringe benefit tax treatment.

The Complexities of the Current Reality

Blue dot tax tech helps businesses to efficiently track, report, and calculate taxable employee benefits for effortless compliance. Our solutions are based on 5 pillars:

Get a head start on 2023 by automating your taxable employee benefits with Blue Dot!

* Mandatory Fields