What Is a VAT Invoice?

The Blue dot Team

The Blue dot Team

Are you registered for Value Added Tax (VAT)? If you’re registered, about to become registered, or thinking about registering for VAT, you will need to know how to create a VAT invoice.

Fortunately, this is relatively easy.

But first, before we dive into the ‘how’ of creating a VAT invoice, let’s look at what VAT is and how it works.

VAT is a consumption-based tax placed on almost all goods and services sold by a business to other businesses and consumers. It is called a consumption tax because consumers pay in full for the VAT placed on goods and services while some companies don’t – you’re reimbursed for any VAT you spend if you’re registered for VAT. The amount of VAT charged is determined by a set percentage which varies depending on the country – as of 2023, it is 20% in the UK and 21% in Europe.

If you earn more than the annual turnover threshold of £85,000 in the UK, then you will need to register for VAT. Companies below that threshold are also welcome to register, even though it’s not mandatory.

When you have registered for VAT as a business, you must add VAT to your goods and services, which means you need to issue a VAT invoice. This is a standard invoice, but it now includes the amount of VAT added to the final cost to the customer. It is mandatory for you to issue a VAT invoice if you are registered for VAT.

Of course, there are exemptions and rules that affect which goods and services are charged the full VAT percentage of 20%, which ones are exempt, and which ones get a reduced VAT rate. When you register for VAT, you will find out exactly which VAT amount you can charge based on your line of business, and this will be reflected on your VAT invoice.

VAT invoices are absolutely critical. At first, you may think it’s just more admin work – now with an extra line item for your VAT – but it benefits your business.

How?

If you meet the VAT invoice requirements, you must issue a VAT invoice whenever you provide services to another VAT-registered company or a consumer. In the UK, this invoice must be issued within 30 days of you providing the services or goods to your customers, but in the EU this is required within only 15 days.

For example: You’ve just sold a customised sofa to your business customer and have already made the delivery. You will now have to issue them an invoice that includes the line item costs of the product and its delivery (if this is an extra fee) along with the VAT. The total amount on the invoice will include all the items and the VAT which your customer needs to pay. You must also issue this invoice to your customer within a month after providing the service.

Only a company registered for VAT is allowed to issue a VAT invoice, which forms a critical part of your business accounting. Ensure you keep copies of your VAT invoices, digitally and physically (if relevant), so you can provide them as proof to the tax authority. You must keep a copy of every VAT invoice you issue.

If you’re not yet registered for VAT, you can register when your business exceeds the annual threshold of £85,000. This is determined by the date of your last invoicing period, so if you exceed this threshold within the year, you still need to register for VAT. You can register if you’re not over the threshold, however, if you’d like to start invoicing for VAT.

If your goods and services are exempt from VAT, then your business is exempt from paying VAT, which means you cannot add VAT to your invoices.

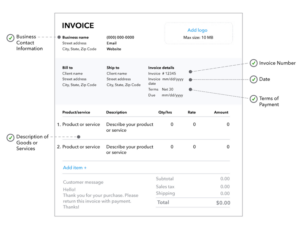

Creating a VAT invoice is very similar to creating a standard invoice. You’ll need to ensure it contains all the basic information that will keep the tax authority happy and that will ensure your business remains compliant with regulations.

Because your VAT invoice is essential to both the tax authority and your business records, it’s important to include as much information as possible. Here are the details that are mandatory for every VAT invoice you issue:

If you happen to be working with reverse charge VAT fees, you must include this information on the VAT invoice. The same applies to any special schemes or exemptions your business may have. If you have to operate under specific rules, you must manage your VAT invoicing requirements accordingly.

Below is an example of a VAT invoice that includes the mandatory information:

You can’t edit if you’ve made an error on an already-issued VAT invoice. You need to issue your customer with a credit note and then send through a new invoice with the correct information included.

If you realise too late that you’ve made an error on your VAT invoice, the tax authority recommends you either account for the higher amount in your records if you charged too much, or that you account for the amount you should have charged if your fee was too low.

There are several different types of VAT invoices, so the one you use for your business will depend on your type of business and what unique criteria you need to abide by as a company.

A full VAT invoice will include all of the information outlined in our VAT invoicing guide above and is the most common form of VAT invoice. It has your company name, address, VAT number, unique invoicing number, line items, unit costs, VAT charges and total cost.

A simplified VAT invoice is a smaller version of the full VAT invoice and can only be issued on amounts of less than £250. It includes all prices as VAT inclusive so you don’t have a line item with the net price followed by the VAT cost, you just enter the total cost. You don’t need to include your customer’s name and address on this invoice.

This invoice is as detailed as a full invoice, but it has the VAT-inclusive price of each item included on each line and at the bottom of the invoice in the VAT-inclusive total. These are only allowed for sales over £250 and with customer approval – if your customer doesn’t want the VAT-inclusive amounts, maybe because they also need to claim VAT, then you will need to issue a full VAT invoice.

A self-billed VAT invoice is only allowed with prior agreement between your business and your customer and if you are both VAT registered. You will be expected to sign a self-billing agreement to ensure this is in writing. To stay in line with VAT regulations, you will then have to keep a copy of the agreement; not submit any sales invoices to your customer for any transaction during the period outlined in the agreement, accept the self-billing invoices your customer sends you; and notify all parties if you change your VAT number or cancel your VAT registration.

Now that you know the basics, it’s a good idea to invest in a digital VAT invoicing platform that will allow you to automatically create, populate and manage all of your VAT invoices. With the right digital solution in place, your business details, your customer’s details, line item information, VAT charges, and total costs will all be automatically entered into a set VAT template. This template will be aligned with tax compliance standards to include all the information you need to be compliant.

Investing into a solid solution that can track, manage, and issue your VAT invoices helps you maintain exceptional documentation and record keeping while ensuring your customers have what they need to stay compliant and on top of their own accounting admin. The right solution, such as Blue dot, will also help you manage all the other finely tuned details that come with VAT, such as reclaiming expenses from business trips and so much more.

* Mandatory Fields